Vanadium has a strong history in steel production, but the critical metal’s growing use in vanadium redox flow batteries (VRFB), for stationary energy storage is driving new developments.

These batteries are becoming increasingly popular as more countries invest in renewable energy projects – and they’re perfect for large-scale energy storage because of their long lifespan and ability to store power from solar and wind sources.

While China currently dominates vanadium production, US Geological Survey statistics suggest Australia actually hosts the highest vanadium reserves in the world, at 8.5Mt as of 2024.

And it’s Queensland that leads the charge. Blessed with natural resources, the Crisafulli State Government has announced plans for Australia’s first vanadium battery supply chain.

A partnership with Vecco Group and Japanese trading giant Idemitsu, it will invest $10 million into a commercial-scale electrolyte facility in Townsville.

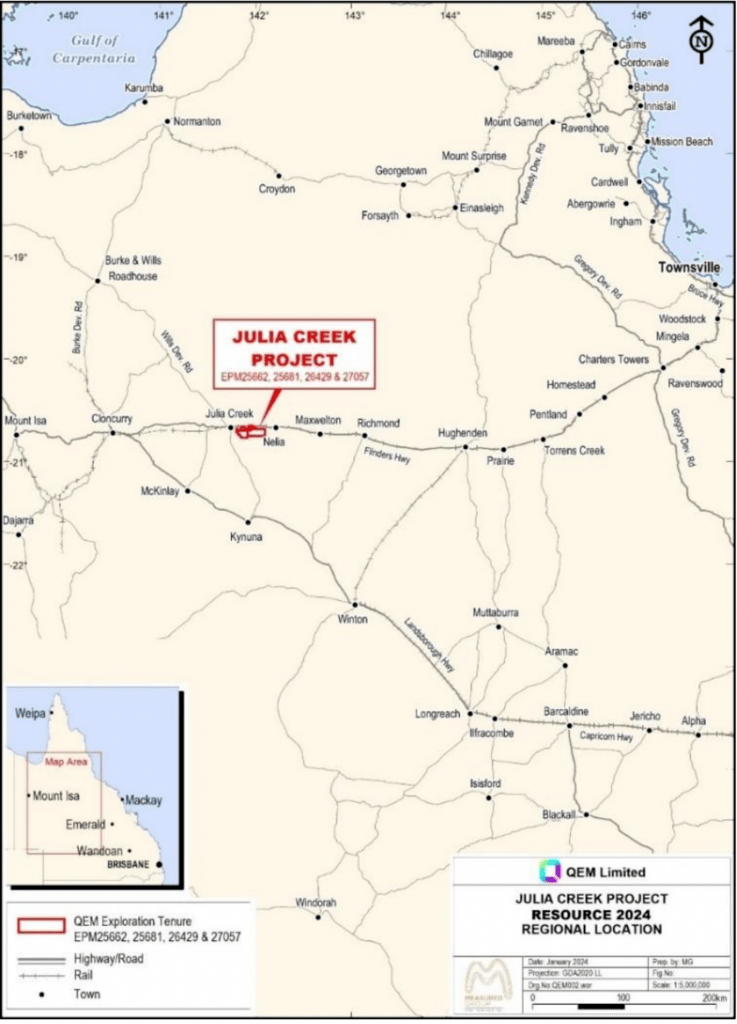

Notably, the plant will use ore from the Julia Creek region, and is expected to anchor a pit-to-port product manufacturing chain, supplying vanadium flow batteries for global energy storage markets.

“This investment forms part of our strategy to link international investors with Queensland innovation, by backing projects that leverage our strengths and create more jobs for our regions,” Minister for Natural Resources and Mines and Minister for Manufacturing Dale Last said.

“It also leverages the ongoing work of the Resources Cabinet Committee to delivery stability and investment-friendly policies for the sector so that projects can get off the ground faster.”

Early works are scheduled for 2026 and operations are set to commence in early 2028.

What does this mean for Julia Creek?

That has thrust a spotlight on vanadium suppliers in the rich Queensland minerals province, with ASX investors having access to the thematic via QEM’s (ASX:QEM) Julia Creek vanadium and oil shale project. It has a resource of 2.87Bt at 0.31% V2O5, with 461Mt at V2O5 in the indicated category.

It also hosts an in-situ 6.3 million barrels of oil equivalent resource, but that’s a story for another day.

Its potential scale has been recognised by the Queensland Government, which granted a ‘Coordinated Project Declaration’ in December 2024 that will streamline the entire approvals process, making it easier and faster to get through regulatory requirements while still meeting environmental and community standards.

Its development credentials were further enhanced in June when the Queensland government finalised the terms of reference for an environmental impact statement for Julia Creek, allowing the company to progress its environmental assessment – which is being carried out alongside the pre-feasibility study.

It’s essentially another stepping stone on the path to production, with one less hurdle for the company to get Julia Creek up and running as it navigates the approvals process.https://stocknessmonster.com/widgets/471720501658ddff/stock-full#qem

CMG also has vanadium in QLD

Just down the road from Julia Creek is Critical Minerals Group’s (ASX:CMG) Lindfield vanadium project, which has a resource of 713Mt at 0.32% vanadium pentoxide. Over 68% sits in the higher confidence indicated category.

Part of this resource is contained within the oxidised zone, which also features higher grades that the company expects to result in significantly lower vanadium mining costs due to the low strip ratio.

CMG recently received a $900,000 progress payment under its $2.7m grant agreement with the Department of Industry, Science and Resources after achieving key milestones in the development of its domestic vanadium electrolyte end-to-end supply chain.

This includes pilot plant test work and processing flowsheet development, environmental field studies, preparation of the mining lease application, identification of the preferred bulk sampling site, and completion of front-end engineering and design for the vanadium electrolyte manufacturing facility.

Plus a vanadium play in WA

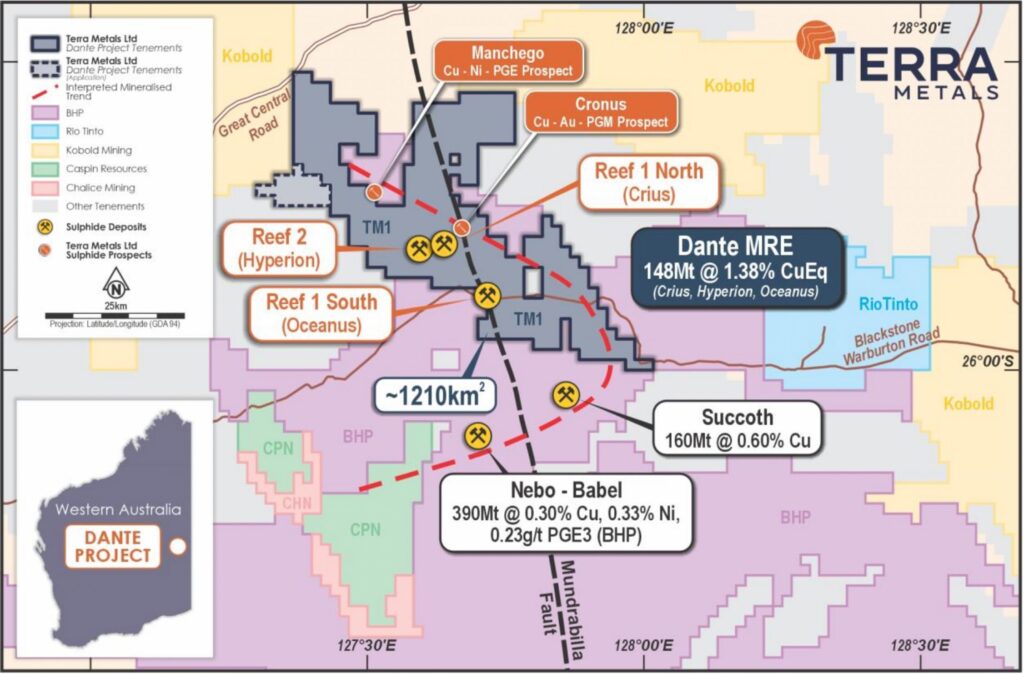

Notable vanadium plays in WA include Terra Metals (ASX:TM1), which has surged 475% in the past six months to a record market cap of $72m after attracting a host of noteworthy institutions to invest in its Dante project.

A maiden resource last month clocked in at 148Mt at 14.8% titanium dioxide, 0.54% vanadium pentoxide, 0.18% copper and 0.33g/t PGE (gold, platinum and palladium).

That amounts to 22Mt TiO2, 800,000t vanadium pentoxide, 270,000t copper, 400,000oz gold, 880,000oz platinum and 330,000oz palladium.

A higher grade indicated resource includes 38Mt at 18.4% TiO2, 0.73% V2O5, 0.23% Cu and 0.72g/t 3PGE (1.87% copper equivalent) for 7Mt of TiO2, 280,000t V2O5, 90,000t Cu, 200,000oz gold, 500,000oz platinum and 180,000oz palladium.

Earlier this week, the company said drilling at the Southwest prospect had revealed a 58m titano-magnetite reef from 132m, marking the thickest reef hit so far at Dante.

Assays are pending but the intercept lies within a newly mapped 5.2km reef corridor, expanding the project’s scale and potential.

Met testwork has already shown Terra can produce three high grade commercial concentrates – a titanium-ilmenite concentrate, a vanadium-magnetite concentrate and a copper-gold-PGE sulphide product, all of which are in demand from industrial offtakers.

A decision to focus on investors in the cashed-up Singaporean market has worked wonders, with esteemed fund Tribeca one of Terra’s top holder with 12.57% of its stock and energy and coal investors GEAR and M Resources CEO Matt Latimore entering first in a $4m placement before topping up in a $15m cash call in August.

“Where the polymetallic nature (of the deposit) makes it complicated for the Australian retail market, (that attribute) is actually the value that is seen by these sophisticated groups who build mines and are connected to the commodity trading hubs and the Chinese market,” he told Stockhead’s Josh Chiat.

Line said the company is seeing strong interest from vanadium buyers as China builds out vanadium redox flow battery production lines.

And Terra’s native WA has also been an emerging adopter of vanadium battery technology. The WA State Government has announced the construction of the State’s first locally built grid scale VRFB to be sized at 50MW/500MWh.

The $150m facility is slated to open in 2029, an early tester to provide long duration storage to stabilise WA’s power grid as it attempts a shift away from coal-fired power.https://stocknessmonster.com/widgets/471720501658ddff/stocks-full#cmg,tm1