The world is accelerating toward a renewable future. Solar and wind power are now the fastest-growing sources of electricity, but their variability continues to pose a challenge. Storage technologies bridge the gap between generation and demand, yet lithium-ion batteries, while dominant, are most efficient for durations up to a few hours. The energy system of the future requires solutions that can store electricity for days, weeks, or even entire seasons. This is where Compressed Air Energy Storage (CAES 2.0) comes into the picture.

What is CAES 2.0

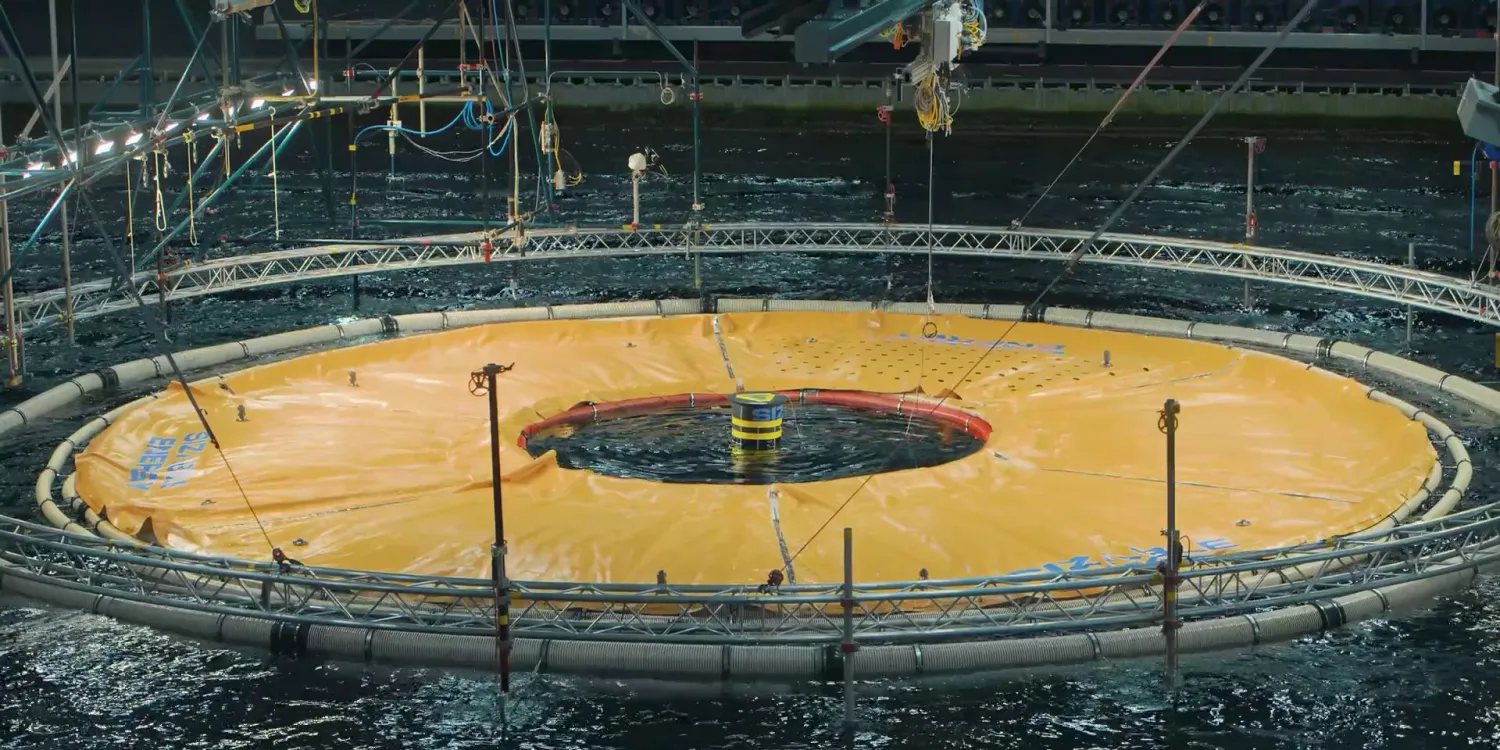

CAES is not new. The first large-scale plant was built in Germany in 1978 at Huntorf, followed by another in Alabama in 1991. Both still operate today, providing valuable lessons. These first-generation systems used surplus electricity to compress air and store it in underground caverns. When demand rose, the air was expanded through turbines to generate power. However, they relied on burning natural gas to reheat the compressed air, which limited efficiency and reduced environmental benefits. CAES 2.0 is different. It incorporates advanced designs that capture and reuse the heat generated during compression, eliminating or minimizing the need for fossil fuels. Variants such as adiabatic CAES store the heat in thermal materials and return it during expansion, raising efficiency dramatically. Isothermal systems attempt to keep air temperature constant during compression and expansion to reduce losses. Hybrid systems couple CAES with other media such as molten salts or even carbon dioxide, pushing the frontier of energy storage science.

The Market Momentum

The energy storage sector is booming. The global stationary storage market was valued at around 90 billion dollars in 2024 and is expected to exceed 230 billion dollars by 2032. Within this, CAES is rapidly regaining attention. Analysts estimate the CAES market will expand from 0.55 billion dollars in 2024 to about 1.2 billion dollars by 2030, a compound annual growth rate of more than 17 percent. Some forecasts are even more ambitious, suggesting growth from 6.6 billion dollars in 2024 to over 35 billion dollars by 2033.

This growth is not speculative. Companies such as Hydrostor in Canada are deploying advanced adiabatic CAES systems in caverns across North America. Hydrostor’s Goderich facility in Ontario is already operating, and the company has plans for projects in California and Australia with hundreds of megawatts of capacity. Meanwhile, Energy Dome in Italy has pioneered a CO₂-based variant where compressed carbon dioxide instead of air is used as the working fluid. The higher density and favorable thermodynamics of CO₂ allow for more compact designs with high efficiency.

The graph above illustrates the market trajectory of CAES through 2032, showing conservative, base, and aggressive growth paths. Even at the most cautious outlook, the market more than doubles in under a decade.

Efficiency Matters

Efficiency is a crucial metric in energy storage. First-generation CAES systems achieved only around 40 to 45 percent round-trip efficiency. By comparison, lithium-ion batteries often exceed 85 percent. This gap limited CAES deployment.

CAES 2.0 closes the gap substantially. Adiabatic designs can reach 65 percent efficiency, hybrid approaches about 70 percent, and isothermal concepts have demonstrated up to 75 percent in simulations and pilots. While still below batteries, the advantage of CAES lies in duration. Unlike lithium-ion, which becomes uneconomical for more than eight to ten hours of storage, CAES can scale to store energy for days at lower marginal cost.

The chart shows how each technology variant improves upon the classical diabatic system. The trend clearly favors designs that capture or control heat, proving that innovation can unlock performance gains.

The Business Model

The value of CAES comes not only from efficiency but from the revenue stack it can capture. A 300 MW plant operating with ten hours of storage can deliver multiple services. Energy arbitrage, where cheap off-peak power is stored and sold at peak prices, provides the foundation. Capacity payments from grid operators reward CAES for being dispatchable. Ancillary services such as frequency regulation and spinning reserve add layers of value. Seasonal storage, especially in markets with heavy renewable penetration, commands a premium.

Hydrostor’s Willow Rock project in California, for example, is designed to provide eight hours of storage capacity to the California grid, helping balance increasing solar generation. The project will participate not only in energy markets but also in capacity auctions, capturing multiple streams of revenue.

The revenue breakdown highlights the balanced contribution of arbitrage, capacity, ancillary services, and seasonal premiums. Together, these can amount to hundreds of millions of dollars annually for large-scale plants.

Geographic Suitability

Not every region is equally suited for CAES. Geology plays a decisive role. Salt caverns are particularly advantageous due to their impermeability and ability to handle pressure cycles. Countries with abundant salt formations such as the United States, Germany, and China are well positioned. Aboveground tanks are technically possible but far more expensive. At the same time, CAES thrives where renewable overgeneration is high. China, for instance, already experiences frequent wind curtailment in northern provinces. Germany faces solar surpluses during summer. Australia’s renewable boom is straining its grid. In all these cases, CAES can absorb excess generation, reduce curtailment, and provide firm power when needed.

The scatter plot positions countries by geological suitability and renewable overgeneration potential. The United States, Germany, China, and Australia emerge as leaders where CAES deployment could scale most effectively.

Project Development Timeline

CAES projects are capital intensive and require long lead times. From feasibility studies to permitting, engineering, construction, and commissioning, the full cycle can take up to eight or nine years. This is longer than battery projects but comparable to pumped hydro, the other dominant long-duration storage technology.

A practical example is Hydrostor’s projects in California, which have taken years to progress through environmental approvals and financing. Yet once built, CAES facilities can operate for decades with relatively low degradation, unlike batteries that suffer from cycle life limitations.

The Gantt-style timeline illustrates the stages of a typical CAES project. Each step requires significant effort and coordination, but the longevity of the asset justifies the investment.

Comparing with Alternatives

CAES is often compared to pumped hydro, the most established form of long-duration storage. Pumped hydro boasts high efficiency and scale but requires specific topography and faces ecological concerns. CAES, in contrast, is more flexible geographically, particularly in regions with suitable caverns. Compared to lithium-ion, CAES has lower efficiency but shines in durations beyond ten hours, where battery costs escalate. Other emerging technologies include flow batteries, hydrogen storage, and thermal storage. Each has merits, but CAES offers a proven mechanical solution with the advantage of decades of operational history.

Strategic Recommendations

For CAES to realize its potential, several strategies are crucial. First, site selection must prioritize regions with strong renewable penetration and suitable geology. Second, project developers should pursue modular deployment to build confidence before scaling. Third, revenue certainty through long-term contracts with utilities or grid operators will be critical to attract financing. Fourth, continued innovation in thermal storage and cycle efficiency is essential. Finally, favorable policy frameworks, such as inclusion of CAES in clean capacity programs and carbon-free storage credits, will accelerate adoption.

Outlook and Conclusion

Compressed Air Energy Storage is on the cusp of a renaissance. With modern engineering and innovative designs, CAES 2.0 overcomes the limitations of its predecessors. The combination of low marginal cost, scalability, and ability to provide long-duration storage makes it an indispensable part of the energy transition toolkit. The next decade will determine how widely CAES scales. If early projects succeed in proving both technical reliability and financial returns, CAES could secure its place alongside pumped hydro and batteries as one of the three pillars of global energy storage. In doing so, it will help unlock a future where renewable energy is not just abundant but also reliable, round the clock and year round.