Scientists in the UK have compiled a new database of adiabatic compressed air energy storage projects. Using this data, they were able to determine the experience rate and identify the conditions under which the technology would be economically viable. According to their findings, costs have declined at a 15% learning rate since 2013.

Agroup of researchers led by the United Kingdom’s King’s College London has compiled a comprehensive database of adiabatic compressed air energy storage (A-CAES) projects, gathering information on both operational systems and planned installations around the world. By analyzing this dataset, they were able to calculate the technology’s experience rate (ER), a measure of how costs decrease as cumulative production or deployment increases, and identify the specific conditions under which A-CAES would be economically viable.

“Long duration energy storage (LDES) is vital for grid stability, enabling the storage of renewable energy for periods ranging from days to years,” the researchers explained. “LDES technologies include compressed air energy storage (CAES), which generates pressurized air using compressors, stores it in containers or underground caverns, and releases it to drive turbines that generate electricity. Recently, A-CAES systems have been proposed to eliminate the need for natural gas by storing compression heat and reusing it during air expansion, thereby ensuring power capacity and improving energy efficiency.”

The academics noted that, prior to their work, comprehensive data on A-CAES – including capital costs, product prices, and cumulative installed capacities – was largely unavailable. To fill this gap, they compiled a robust database using a wide range of sources, including peer-reviewed literature, industry reports, energy storage databases, news articles, and interviews with manufacturers and project developers.

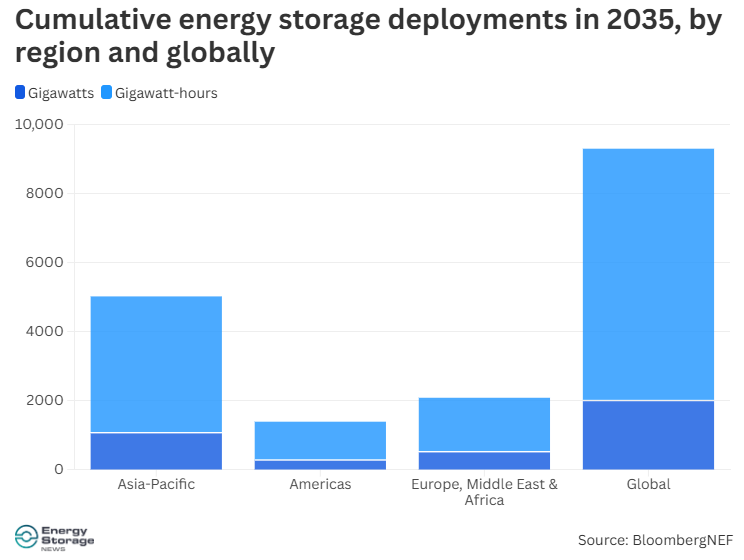

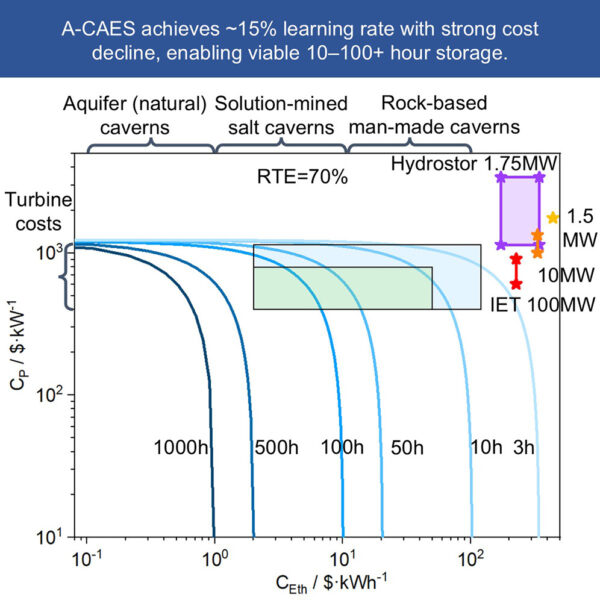

Their analysis shows a dramatic reduction in costs over the past decade. In 2013, the price/kWh of A-CAES exceeded $10,000, whereas by 2024, it had fallen to approximately $120/kWh. This sharp decline was primarily driven by the increased scale of projects and the maturation of the technology, which expanded from relatively small systems of 0.5–1.5 MW in 2013 to large-scale installations of 10–100 MW today. Using these data points, along with numerous others collected over the years, the team applied a validated learning curve model to estimate the technology’s ER, providing insights into how costs decrease as deployment grows.

Experience rate (ER) represents the percentage by which a technology’s cost falls each time cumulative deployments double. Using their database, the researchers calculated an overall ER of 33% when including all data points, but a more conservative ER of 15% when considering only projects larger than 10 MW.

“High costs from small-scale, experimental projects in the early 2010s likely inflated the overall ER, making the 15% rate more reflective of anticipated future deployments,” the team explained. They further projected that, following the 15% ER trend, market-average prices could fall below $157/kWh for capacities above 10 GWh and $92/kWh for capacities above 100 GWh.

To assess the robustness of these estimates, the researchers applied a Monte Carlo sensitivity analysis, introducing 20% uncertainty to each data point and generating thousands of potential learning rates. Even under this uncertainty, the ER remained between 10% and 20%, confirming that the observed cost-reduction trend is reliable.

Building on these insights, the team conducted a discounted cash flow (DCF) analysis to determine the conditions under which A-CAES projects could be economically viable. The round-trip efficiency (RTE) was assumed to be 70%, reflecting the performance of current projects, and price inputs were drawn from recent installations. The DCF analysis considered a range of storage durations: 3, 10, 50, 100, 500, and 1,000 hours.

Their findings indicate that energy-related costs, rather than power-related costs, are the primary determinant of economic viability for A-CAES.

“Our lifecycle discounted cash flow analysis suggests that A-CAES could achieve economic viability for storage durations of 10–100 hours under optimal geological conditions,” the team noted. “Moreover, with further reductions in storage costs to the order of $1/kWh, it could support durations exceeding 100 hours, making A-CAES a highly promising solution for balancing renewable energy and enhancing seasonal grid resilience.”

Their findings are available in “Cost Reducing Adiabatic Compressed Air Energy Storage for Long Duration Energy Storage Applications,” published in iScience. Researchers from the United Kingdom’s King’s College London, Energy System Catapult, University of Warwick, and China’s China University of Petroleum (Beijing) have participated in the study.