Decarbonizing the power grid requires solving a fundamental mismatch: renewable generation peaks rarely align with demand peaks. While lithium-ion batteries have successfully addressed intraday arbitrage and frequency regulation, they cannot economically bridge the multi-day generation gaps that will become increasingly common as renewable penetration exceeds 60-70% of grid capacity.

This isn’t a theoretical concern. It’s the infrastructure constraint that will determine whether our decarbonization targets remain achievable or become aspirational

The Duration Gap in Grid Planning

The intermittency challenge extends far beyond minute-to-minute or even hour-to-hour fluctuations. Meteorological patterns create sustained periods of low renewable output, overcast weeks in winter, multi-day periods of low wind, and seasonal variations in solar irradiance. These events require storage systems capable of 10–100 plus hour discharge durations.

Consider the operational reality: Regions like California and parts of Northern Europe regularly experience 3-5 day periods where both solar and wind generation drop below 30% of installed capacity. During these events, the grid must either rely on natural gas peakers, import power from neighboring grids, or implement demand curtailment. As gas plants are retired to meet climate commitments, only two options remain viable: massive overcapacity in renewable generation or long-duration storage deployment.

The overcapacity approach is economically untenable. Analysis suggests that meeting reliability standards with generation alone would require building 150-200% of peak demand capacity. Long-duration energy storage (LDES) provides the more capital-efficient solution.

The Curtailment Problem at Scale

Current grid infrastructure cannot absorb the renewable energy we’re already generating during periods of peak production. In 2023, regions globally, including California, curtailed over 2.4 million MWh of utility-scale renewable energy, enough to power approximately 350,000 homes for a year. This represents not just lost environmental benefit, but stranded capital in generation assets that cannot deliver their full economic value.

As renewable capacity continues expanding to meet decarbonization targets, curtailment will accelerate non-linearly. Without adequate storage, we face the paradox of needing to slow renewable deployment precisely when climate goals demand acceleration.

LDES systems convert this economic waste into grid assets. By capturing excess generation during peak production periods and discharging during high-demand or low-generation windows, these systems improve capacity factors for renewable assets while reducing the need for fossil fuel backup generation.

Why Short-Duration Storage Cannot Scale to This Application

Lithium-ion batteries excel at applications requiring high power density and rapid response times over 2-4 hours windows. Their cost structure, however, makes them unsuitable for longer durations. Energy capacity scales linearly with cost, adding duration requires proportional increases in cell count, thermal management systems, and safety infrastructure. For a 10-hour discharge system, lithium-ion capital costs typically exceed $300/kWh. For 100-hour durations, the economics become prohibitive, often reaching $500-800/kWh when factoring in balance-of-system complexity and safety requirements.

Moreover, lithium-ion systems face material supply constraints. Scaling to the terawatt-hour storage capacity required for deep grid decarbonization would place unsustainable demand on chemical supplies, which are already under strain due to their role in the mobility transition, creating new resource bottlenecks and geopolitical dependencies.

The grid requires purpose-built solutions for long-duration applications.

The LDES Technology Landscape

Multiple technologies are advancing to fill this gap; each suited to different deployment contexts:

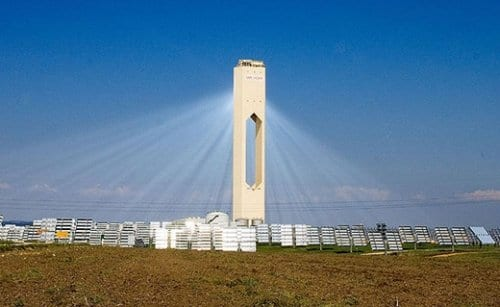

- Pumped hydro storage remains the most mature LDES technology, representing over 95% of current grid-scale storage globally. With 70-85% round-trip efficiency and decades-long asset life, it provides benchmark economics where suitable topography exists. However, site availability severely limits expansion potential, and permitting timelines often exceed 10-15 years.

- Compressed air energy storage (CAES) offers 10-100 plus hour durations with lower environmental impact than pumped hydro. Advanced adiabatic systems aim to achieve 65-70% efficiency. Deployment is traditionally constrained by the need for suitable geological formations, such as salt caverns, depleted gas fields, or hard rock caverns, which significantly limits geographical flexibility. To overcome this, alternative designs are emerging that utilize purpose-built, buried, or above-ground pressure vessels and tanks to store the compressed air, substantially expanding the potential sites for CAES deployment. However, the adoption of tank-based systems is currently limited by high capital costs; engineered steel or composite vessels are inherently more expensive than utilizing a naturally occurring underground cavern. Crucially, tanks have a far lower energy density compared to geological storage, meaning a massive number of vessels are required to achieve utility-scale storage capacity, which pushes up the total Levelized Cost of Storage (LCOS) for long-duration applications.

- Flow batteries represent the most promising technology for scalable, geographically flexible LDES deployment. While several flow battery chemistries exist, those relying on costly or scarce materials (such as vanadium) are severely limited in their potential for large-scale, cost-effective energy storage. Unlike conventional batteries where energy and power are coupled, flow batteries separate these parameters: power is determined by the reaction stack size, while energy capacity scales independently with the volume of the electrolyte stored in external tanks. This architectural advantage provides superior economics for duration-focused applications.

Iron-based flow battery chemistries offer particularly compelling characteristics. While Iron deposition during charging imposes practical constraints, the system architecture still provides a superior economic advantage over integrated battery systems for applications well beyond a typical four-hour duration. Here are some of the advantages:

- Resource Abundance: Iron, salt, and water-based electrolytes eliminate critical mineral dependencies and supply chain vulnerabilities.

- Safety Profile: Non-flammable, non-toxic chemistry enables deployment in urban and suburban contexts without specialized fire suppression infrastructure.

- Longevity: Demonstrated 20 plus years operational life with minimal capacity degradation; the electrolyte itself does not degrade and can be reused indefinitely.

- Cost and Scaling: Manufacturing scale-up and supply chain development are driving costs toward deep long-duration targets. Crucially, because the cost of energy capacity ($/kWh) is tied mostly to the price of the inexpensive electrolyte rather than the power stack, these batteries achieve a dramatically lower Levelized Cost of Storage (LCOS) than lithium-ion for applications exceeding 8-10 hours.

However, one of the biggest hurdles for LDES isn’t just a lack of working technology, it’s that the rules and structures of our electricity markets are outdated. I won’t talk about policy as I am not an expert on the matter, and as this is a matter for an article by itself, so I will focus on one of the problems that I do know from a close encounter.

The challenge for LDES is a classic “chicken and egg” problem:

- On one side: Utilities and grid operators, whose primary mandate is reliability, will only adopt and incorporate LDES after it is proven, certified, and operating at scale.

- On the other side: LDES developers (often startups) cannot achieve that necessary proof and certification until they can secure initial commercial-scale projects, which require market signals and customers willing to pay for the long-term benefits LDES provides.

This fundamental barrier is amplified because the market rules, which are supposed to encourage necessary innovations, currently fail to properly value LDES.

Conclusion

The renewable energy transition has reached an inflection point. Generation capacity is being deployed at unprecedented rates, global solar installations alone are projected to exceed 500 GW in 2024. But without commensurate storage deployment, particularly in the 10-100 plus hour duration range, this capacity cannot reliably displace fossil generation.

Every MWh of curtailed renewable energy represents failed infrastructure planning. Every reliability event requiring fossil fuel backup demonstrates incomplete system design. Every delayed decarbonization timeline reflects insufficient attention to closing the storage gap.

LDES is not ancillary infrastructure, it’s the enabling technology that determines whether high-renewable grids can function reliably. The technology is ready or rapidly maturing. Economics are improving toward competitiveness. The remaining barrier is policy and market design sophistication.

The question isn’t whether we need LDES. It’s whether we’ll deploy it quickly enough to meet our decarbonization commitments.