Australia’s grid is changing fast. Rooftop solar is everywhere. Utility solar keeps adding gigawatts. Batteries are showing up at a scale that was hard to imagine a few years ago.

In that context, Vast’s VS1 concentrating solar project (CSP) at Port Augusta proposes a different answer for evening electricity, one that was tried in other parts of the world in the past and is rarely built today.

The concept is simple to describe. Mirrors concentrate sunlight onto a sodium receiver at the top of a tower. Heat moves to molten salt tanks on the ground. A steam turbine converts that stored heat to electricity for about eight hours after the sun goes down.

With the announcement that one of the leading CSP plants in the world, Ivanpah in California, will shut down two thirds of its generation decades prematurely, Australia should consider whether to fund and build VS1 carefully.

The question is not whether the physics work. They do. The question is whether a first unit of this design can beat the combination of solar PV and four to eight hours of batteries that are being built across Australia with a high degree of repeatability.

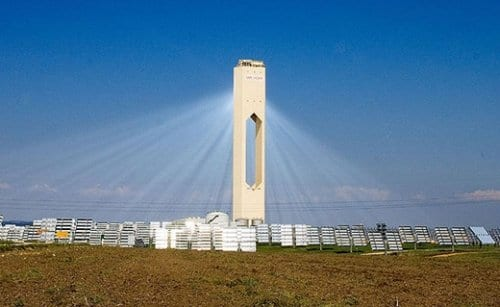

It helps to put VS1 in the longer story of CSP. The first modern wave had the SEGS parabolic trough plants in California in the 1980s and 1990s. They showed that thermal solar could connect to the grid like a conventional plant. Spain’s feed-in tariff era around 2007 to 2013 created a short boom.

Andasol and Gemasolar (pictured above) introduced molten salt storage at real scale. The follow-on builds in the United States tried to turn that promise into icons. Ivanpah used direct steam. Crescent Dunes used a molten salt tower.

Ivanpah fell short on output and needed gas assists to hit targets. Crescent Dunes struggled with receiver failures and long outages. The technology worked on paper. In the field it had low tolerance for design, build, and maintenance errors.

There were successes. Morocco’s Noor complex blended troughs, a tower, and storage to deliver night-time solar. Chile’s Cerro Dominador did the same for a smaller system. Dubai’s hybrid added long salt storage to a fleet that included a lot of PV.

These projects proved that thermal storage can shift solar into the evening at a national scale. They also showed high capital costs, tight construction windows, exacting O&M requirements, and exposure to policy changes.

Over the same period PV modules fell sharply in price. Factory-built lithium batteries moved from pilot to product. Grid-forming inverters matured. When the competing pathway gets cheaper every quarter, a complex thermal system has to clear a higher bar every year just to stand still.

Keeping a tower plant delivering night-time electricity requires routine field work. Each heliostat must be calibrated so its aim stays tight through wind, temperature changes, and sun position, because small errors across thousands of mirrors reduce receiver flux and force derating.

Initial calibration often took months at legacy CSP plants. Dust and salt spray cut mirror reflectance almost one to one and CSP cannot use diffuse light, so haze and airborne dust lower output more than they do for PV.

The field needs frequent washing and brushing that consume water, labor, and vehicle hours, while PV sites can often stretch cleaning intervals with smaller yield penalties. Soiling that sits for days can erase much of the gain from a clear sky day at a CSP site, and cleaning windows reduce production time.

Even when the field performs well, the heat path still hurts economics. Heat moves from the receiver to tanks, then back through heat exchangers and a steam cycle, with losses at each step.

Round trip through storage is well below 100%, and turbine conversion of stored heat adds more losses, so more aperture and more auxiliary energy are needed to deliver each evening kWh. These penalties show up as higher capex, higher O&M, and a higher cost of electricity compared to PV paired with batteries that install faster and are easier to maintain.

VS1 tries to thread some of the needles by separating the hardest pieces of the puzzle. Instead of pumping molten salt up the tower, Vast puts liquid sodium in the receiver loop and keeps the salt at ground level in the storage system.

Sodium has a lower melting point than solar salt and better heat transfer properties in the receiver. That choice attacks the failure mode that took down Crescent Dunes.

Moving salt off the tower reduces freeze risk at height and should simplify the most delicate plumbing. It does not eliminate the core issues with molten salt. Solar salt still freezes around 220 to 240 °C.

The plant still needs heat tracing and careful start and stop procedures. The auxiliary load to keep the salt hot still shows up in the energy and cost balance. The storage tanks and piping still require corrosion management and consistent inspections.

Historical analysis of CSP projects by author

Flyvbjerg’s reference class forecasting, as described in layperson’s terms in his 2023 book with Dan Gardner, How Big Things Get Done, pushes you to take the outside view.

Instead of believing a bespoke plan, you anchor estimates to the actual outcomes of a relevant class of past projects, then adjust for specific differences. It is a structured antidote to optimism bias and strategic misrepresentation that plague large infrastructure.

For CSP towers with molten salt, the reference class includes plants that slipped by months or years and carried higher site overhead, interest during construction, and rework. Using that history to set mid-case overruns is not a guess. It is a disciplined way to price the time value of delay and the cost of technical risk before contracts are signed.

The table reflects this logic by linking observed schedule slips to estimated dollar overruns and by pairing those with tariff or LCOE markers where available. The implication is simple.

If a current CSP project looks like the reference class, you budget for the overrun now and test whether the all-in $/MWh still beats a PV plus battery stack on the same busbar. If it does not, the economics are telling you the plan is still anchored in the inside view.

Taken together, the reference class says VS1 should budget for time slippage and the cost creep that follows. First-of-kind receivers paired with molten-salt storage have repeatedly slipped by a year or more, and the mid-case translation of that delay into money is on the order of 18–37% capex overrun, driven by site overhead, interest during construction, price escalation, and rework.

If you frame VS1 with a pragmatic baseline, the numbers move fast. At 30 MW, 40% capacity factor, 30-year life, and 7% weighted average cost of capital, a $200m all-in capex yields about $173/MWh after adding reasonable fixed O&M. A 20% overrun lifts that to about $204/MWh. A 30% overrun to about $219/MWh. A 37% overrun to about $230/MWh. If the true baseline is closer to $250m, the no-slip case is already near $212/MWh and rises toward the mid-$200s with the same delay assumptions.

On schedule, the sober expectation is a 12–24 month slip unless the engineering, procurement and construction firm puts liquidated damages, proven subsystem pedigrees, and long-lead procurement discipline in place.

On cost, the project needs contingencies sized for at least a mid-20s overrun and a financing plan that absorbs higher interest during construction without pushing the delivered $/MWh out of contention with PV plus 8-hour batteries at the same node.

In plain language, VS1 can earn its keep only if it locks in a capacity-style offtake, de-risks the sodium-to-salt interface before construction, and proves it can hold schedule to keep the LCOE from drifting into the $200/MWh range.

Further, assessment of CSP projects globally finds that most of them are sinks of governmental subsidies significantly beyond legacy levels for photovoltaic installations, never mind modern commercial solar and battery farms.

VS1 is no different. It carries a significant public support stack of up to $290 million: an $180 million ARENA grant plus up to $110 million in concessional finance. Separate funding exists for the co-located solar-methanol project and manufacturing scale-up, which supports the broader hub but is not part of the VS1 power-plant grant.

The schedule overruns, estimated cost overruns, amount of public money required of the few instances of CSP developments makes it clear that CSP is well into the middle of Flyvbjerg’s megaprojects ranking by cost and schedule overrun.

Meanwhile, utility-scale photovoltaic installations are by far the most likely to achieve planned cost and schedule targets. Private money has decided where it should be spending, and it’s on low-risk solar and batteries, not CSP. Public money should be paying attention.

Australia’s grid context makes the comparison with PV and batteries unavoidable. South Australia has a deep midday solar trough and a steep evening ramp. Rooftop systems already meet a large share of daytime demand.

Utility PV keeps adding low cost daytime energy. Large batteries are being built with durations from two to eight hours. They can be staged in blocks, tied to grid-forming inverters, and commissioned quickly.

When batteries provide evening discharge and fast frequency response, the key question becomes whether a thermal plant can match or beat the cost per delivered kWh for the 4 pm to midnight window and do it with enough reliability to anchor an offtake.

There are attributes in VS1’s favor. A steam turbine provides physical inertia, short circuit strength, and voltage support in a way that inverter plants simulate. Eight hours of storage maps to the South Australian evening peak.

A tower plant does not face the same cell or module supply chain cycles as PV and batteries. If the goal is to diversify firm clean capacity, a thermal path is a logical hedge. None of that matters if the first unit cannot lock in construction costs, hit commercial operation on time, and meet availability targets through summer and winter.

An apples to apples test should use a single busbar and the same market. On one side is VS1 with 30 MW nameplate and about 288 MWh of storage. On the other is a solar PV build sized for the energy target plus an eight hour battery stack that can deliver a similar evening profile.

Both need interconnection, civil works, and balance of plant. The CSP path adds heliostats, a tower, a sodium loop, molten salt tanks, a heat exchanger train, a steam cycle, cooling, and extensive heat tracing. The PV plus battery path adds modules, inverters, a BESS with HVAC and fire safety, and controls. Finance sees the difference.

PV and batteries are modular, repeatable, and have many recent Australian references. CSP has no local references and far more bespoke engineering. That changes risk premiums on debt, contingency allowances, and the appetite of insurers.

Operations tip the scales as well. A PV plus battery site is mostly preventive maintenance and inverter or pack swaps. VS1 would have field alignment, receiver inspections, heat tracing checks, salt chemistry management, steam cycle work, and a freeze playbook.

Each item is manageable with the right procedures, but each adds potential downtime and auxiliary draws. Effectively, a CSP plant is like a chemical manufacturing plant or a coal plant, with many full time staff constantly monitoring operations, checking key performance data, doing preventive maintenance and cleaning, and preparing for major refurbishment.

By contrast, solar + BESS plants are mostly hands free with lights out operation. Whether that’s considered a plus or not depends on whether the higher cost of electricity due to labor is worth the extra jobs.

Water use and cooling choices matter in Port Augusta’s climate. Dry cooling avoids a water footprint but reduces output on hot days. Wet cooling helps output but raises OPEX and optics. These are board level tradeoffs because they move the capacity factor and the cost per kWh.

Market design is the other lever. If an offtake values capacity and essential system services, a synchronous plant can earn revenue that a pure energy PPA would not cover. If procurement is energy only, PV plus batteries will be hard to beat. If grid codes raise the bar for system strength and inertia, the relative value of a turbine may increase.

If batteries keep falling in price and reach four to eight hours with strong grid-forming performance at lower cost, the window for a first-of-kind CSP in Australia narrows. Policy and tender design can steer the outcome by asking for firm evening delivery with explicit valuation of services, milestone support, and clear penalties for slippage.

A fair reading of the molten salt history suggests a pragmatic checklist before committing. The sodium receiver must show multi-year reliability at temperature with clean heat transfer to the salt loop. Heat tracing and freeze management must have verified procedures and tested backup power. Auxiliary loads for keeping salt liquid should be bounded by conservative engineering numbers, not marketing targets.

The steam turbine and balance of plant must show availability that matches the revenue model. The EPC must put real liquidated damages on the table for late delivery and underperformance. The offtake must include capacity style payments or ancillary service revenue so the plant is not trying to win only on energy price.

I am skeptical that the all-in cost and risk profile of a first VS1 unit will beat a PV plus eight hour battery stack that connects to the same node in South Australia. The burden of proof is on the project to show on-time delivery, stable operations across seasons, bounded auxiliaries, and a contract that pays for what the plant uniquely provides.

If those conditions are met, building one or two as disciplined pilots tied to capacity and services makes sense. If they are not, the most productive path is to keep adding PV and batteries that are cheaper, faster to stage, and easier to finance.

The goal is a clean grid that covers the evening peak without drama. That is a system outcome, not a technology trophy. If VS1 can deliver that outcome at a cost and risk that competes with the obvious alternative, it earns its place.

If not, Australia already has a juggernaut that does the job. The work now is to put the two options on the same busbar, test the economics and operations with realistic numbers, and make the choice that delivers the most clean kWh during the hours that matter.