reland’s transmission system operator (TSO) Eirgrid has launched a consultation on a proposed procurement mechanism and operational considerations for its long-duration energy storage (LDES) scheme.

It follows the recommendation by last year’s Electricity Storage Policy Framework (ESPF), published by the Department of Climate, Energy and Environment (DCEE), for the immediate procurement of LDES services with the capacity to deliver electricity to the EiGgrid for 4-hours or more.

Research firm Cornwall Insight had said at the time that a lack of LDES policy threatened Ireland’s renewable targets.

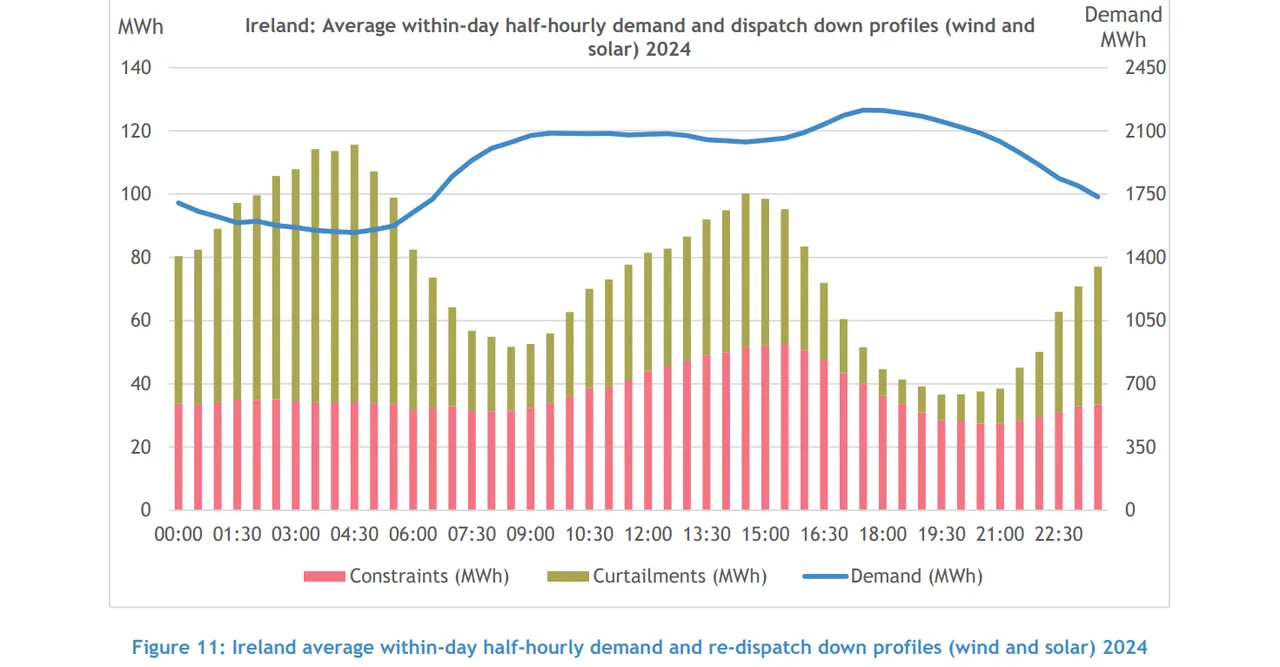

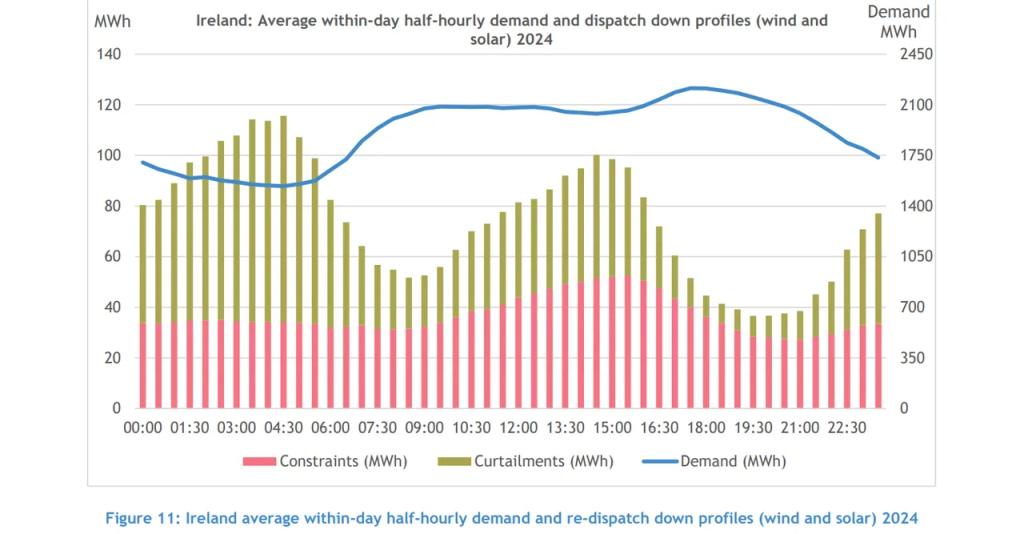

Eirgrid said it is seeking 500MW of the LDES resources. The resources will help the TSO to manage high renewable energy output periods by importing to reduce constraint and curtailment-based re-dispatch, and exporting during lower renewable energy output periods to help manage evening demand ramps as solar generation reduces.

Note that in many other markets, 4-hour systems would not be considered LDES. The duration is standard in the US, Chile and many other markets without LDES-specific policy, though typically those are more solar-heavy renewable energy markets, whereas Ireland is mainly wind.

Eirgrid’s LDES team will hold an industry webinar on 5 November 2025 where it will discuss the plan in more detail.

It comes after the UK’s Department for Energy Security and Net Zero (DESNZ) and regulator Ofgem progressed their LDES scheme, revealing in late September the shortlist of 77 winning projects in its first window. The 77 projects total 28.7GW of capacity and will need to be deployed as 8-hour systems (or higher).

Eirgrid pointed to the scheme in the UK as well as Australia as examples, and also highlighted BESS capacity procurement mechanisms in Greece and Italy that are not labelled as LDES schemes but are procuring capacity with similar discharge duration.

However, contrary to the UK’s cap and floor mechanism, Eirgrid is proposing a floor with a percentage-based revenue sharing component for revenues above the floor. It said that more consideration is needed for the specifics, but has proposed an initial split of 70% of all accrued revenues above the revenue floor going to the LDES asset owner, with the remaining 30% as revenue to the TSO. This would require open book accounting for all revenue streams.