The global energy storage market is not just growing—it’s transforming. While record-breaking installations dominate headlines (projected at 92 GW/247 GWh in 2025, a 23% year-on-year increase), the real story lies in two paradigm shifts: the rise of long-duration storage and the integration of AI-driven energy management. These trends are moving storage beyond short-term grid balancing to become the core of a resilient, renewable-powered future.

1. Long-Duration Storage Takes Center Stage

As renewables penetration deepens, the limitations of 2–4 hour lithium-ion batteries become apparent. The industry is now pivoting to 6–8 hour lithium-ion systems and non-lithium technologies to address multi-day weather disruptions and seasonal variability. For example:

– Compressed air storage: China’s 300 MW Yingcheng salt-cavern project achieves 70% system efficiency with 100% localized equipment.

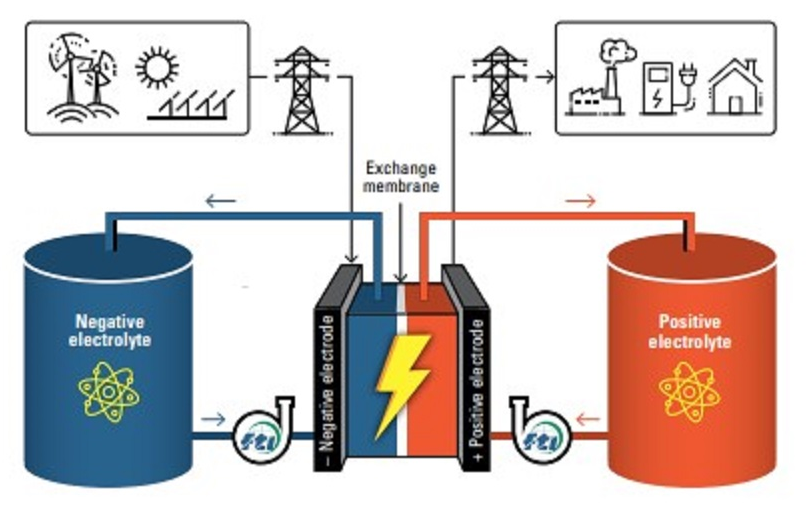

– Flow batteries: Vanadium redox systems in the U.S. enable 12-hour discharge, ideal for wind droughts.

– Policy support: The UK, Australia, and Canada are procuring long-duration projects through targeted schemes.

This shift is critical for regions like Europe, where dynamic electricity pricing incentivizes storage for intraday arbitrage, and for emerging economies like Iraq, where solar-storage hybrids replace diesel generators during prolonged outages.

2. AI Unleashes the Full Value of Storage Assets

Artificial intelligence is revolutionizing storage optimization, turning passive assets into proactive “grid intelligence” tools. In China’s Binyang County, an AI-powered energy management platform slashes wind farm fault detection time from 24 hours to 5 minutes and cuts maintenance costs by $1.4 million annually. Key advances include:

– Predictive analytics: AI models forecast grid congestion and renewable output, optimizing charge-discharge cycles.

– Autonomous systems: Drones and robotics inspect infrastructure, reducing human intervention by 70%.

– Physical AI: Companies like China’s Envision integrate physics-based constraints (e.g., thermodynamics, grid stability) into AI models to eliminate “hallucinations” and enhance reliability.

These innovations address a critical challenge: with renewables dominating power grids in places like Germany and California, AI ensures storage responds to volatility at millisecond speeds.

3. Policy and Markets Adapt to Unlock Revenue Streams

Regulatory frameworks are evolving to reward storage for its full suite of grid services. China’s 2025–2027 Action Plan mandates independent market participation for storage, paving the way for “capacity + energy + ancillary service” revenue models. Similarly:

– Germany’s dynamic pricing (effective January 2025) creates opportunities for households and businesses to leverage storage for price arbitrage.

– Australia’s “Cheap Home Battery Scheme” subsidizes 30% of upfront costs, accelerating adoption.

– U.S. inflation Reduction Act tax credits sustain investment despite geopolitical trade tensions.

These policies acknowledge storage’s role in providing inertia, frequency regulation, and black-start capability—services traditionally supplied by fossil fuels.

4. Global Diversification Beyond China and the U.S.

While China (**>50%** of 2025 deployments) and the U.S. (**14%**) lead, emerging markets are gaining momentum:

– Saudi Arabia and Sub-Saharan Africa are scaling storage to support solar integration and grid modernization.

– Europe’s EMEA region will surpass the Americas in annual installations by 2026.

– Africa, home to 60% of global solar resources, could reach 28 GW of storage by 2030 (IRENA estimates).

This geographic spread mitigates supply chain risks and fosters technology exchange, such as China’s 18 GWh of overseas projects in Belt and Road Initiative countries.

5. The Road Ahead: Intelligence and Duration as Dual Pillars

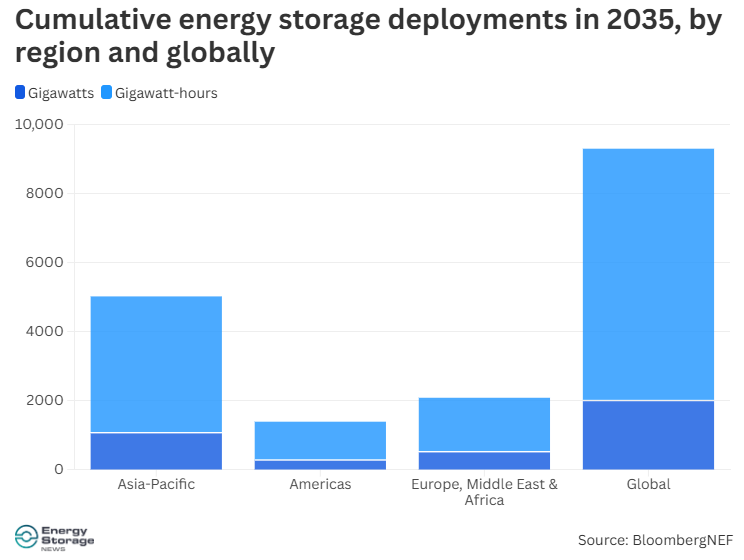

By 2035, cumulative global storage capacity will hit 2 TW/7.3 TWh—**eight times** 2025 levels. The future winners will be those mastering:

– AI-native storage systems that dynamically adapt to weather, markets, and equipment health.

– Multi-day storage technologies like gravity-based systems and advanced compressed air.

– Circular supply chains, with recycled lithium meeting 60% of China’s storage demand by 2030.

Conclusion

The energy storage revolution is entering a new phase—one defined not by capacity alone, but by duration, intelligence, and adaptability. For professionals, this means opportunities in AI-driven grid software, long-duration tech commercialization, and emerging markets. The question is no longer if storage will dominate, but how smart and enduring it will become.